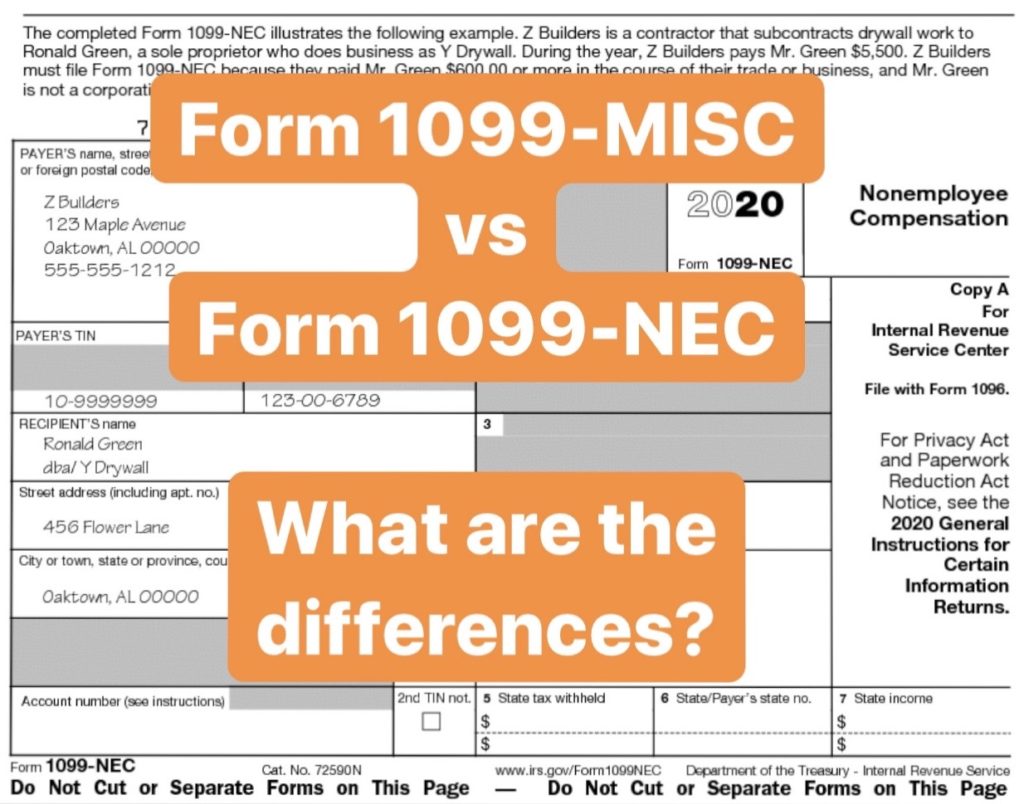

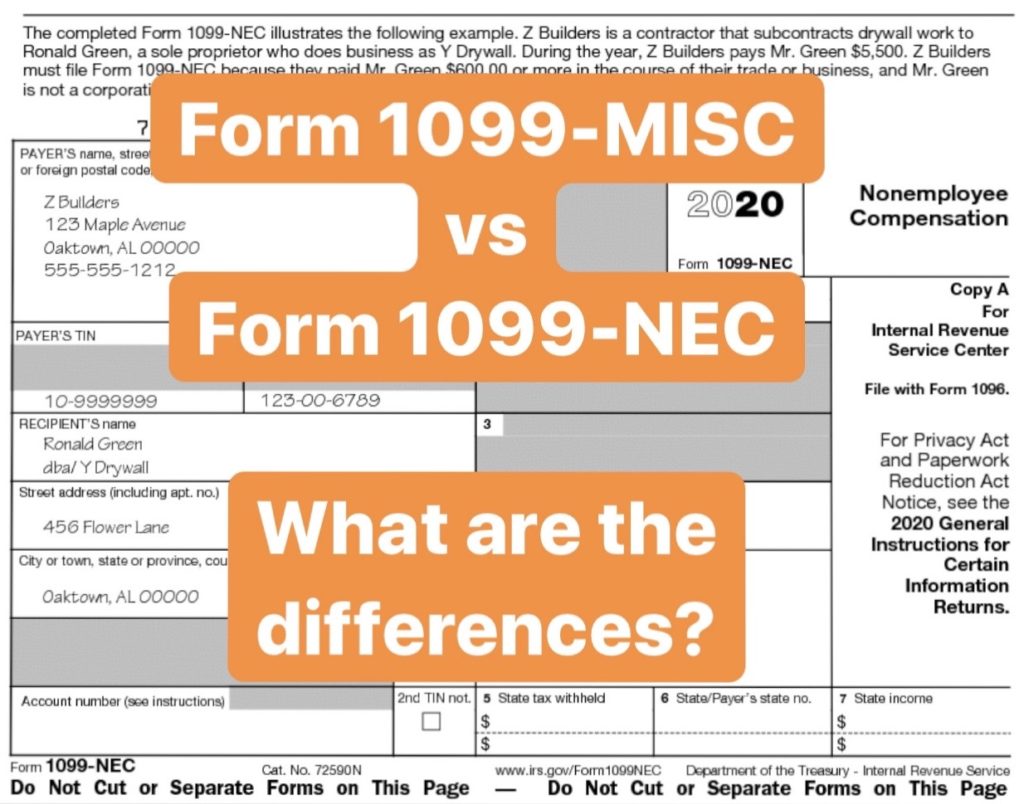

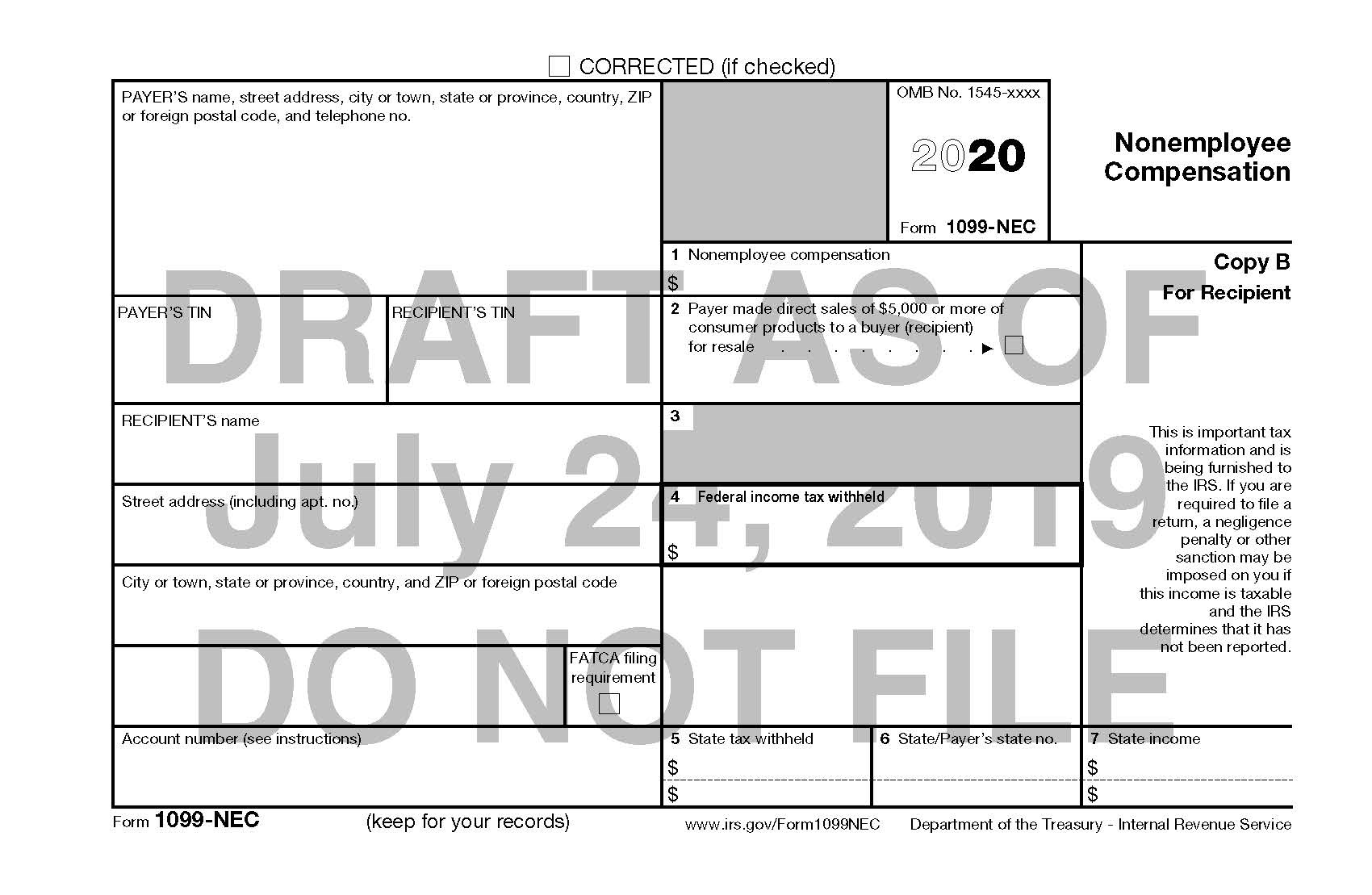

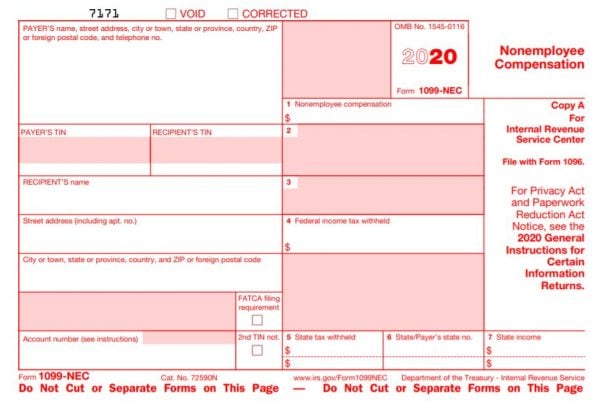

Form 1099NEC is used by payers to report $600 or more paid in nonemployee compensation for business services The IRS issued Form 1099NEC for use beginning with tax year instead of Form 1099MISC Payers fill out the form, send it to independent contractors (excluding attorneys) paid at least $600 in a calendar year, and file a copy withThis tax season millions of independent workers will receive Form 1099NEC in the mail for the first time The 1099NEC is the new form to report nonemployee compensation—that is, pay from independent contractor jobs (also sometimes referred to as selfemployment income) Examples of this include freelance work or driving for DoorDash or Uber Plus, sometimes forms, requirements and processes change, and it's important to stay on top of these shifts to avoid substantial penalties One of the financial forms an independent contractor is likely to encounter during tax season is form 1099NEC It's different from the 1099MISC, which experienced gig workers may already be familiar with

Form 1099 Misc Vs Form 1099 Nec How Are They Different

What is nec on a 1099

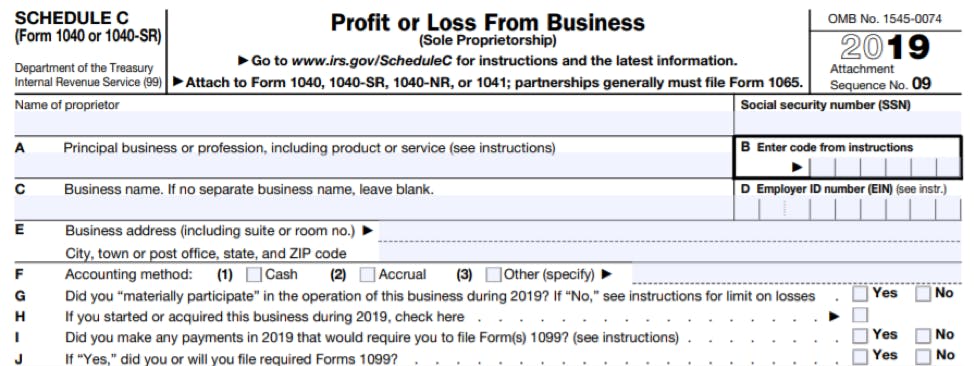

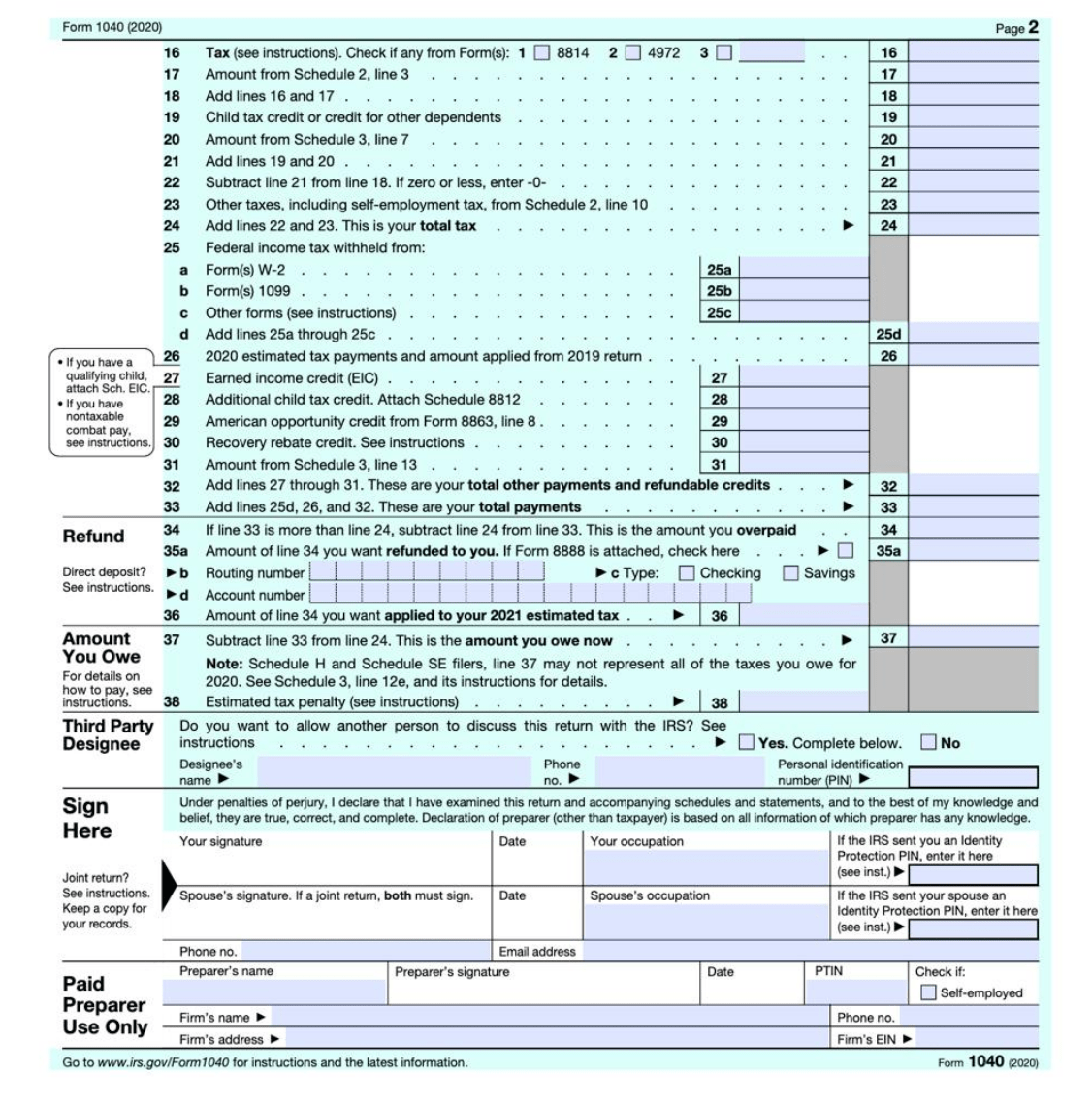

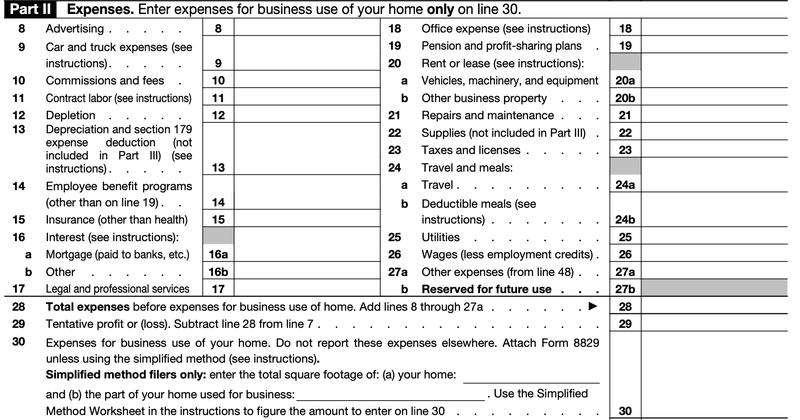

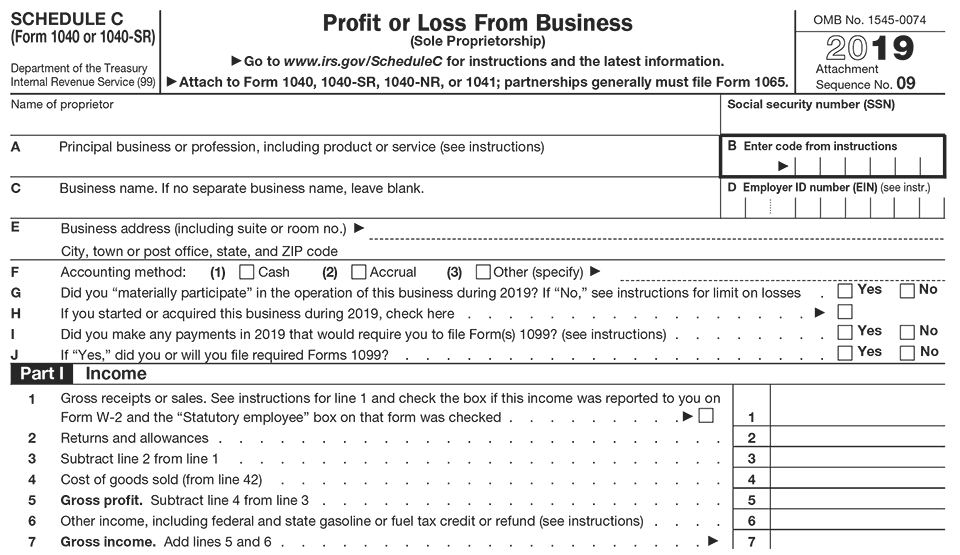

What is nec on a 1099- Here is Schedule C, Part 1 All of the contractor's income must be posted to Part 1, line 1 of Schedule C (Gross receipts and sales) This includes income reported on 1099 forms, and payments under $600 that did not require a 1099 form The contractor's business net income is posted to Schedule 1 of Form 1040, and the amount is added to最も選択された form 1099nec schedule c instructions How to fill out 1099 nec Line 12 for purposes of calculating income tax and to Line 2 of the Schedule SE for purposes of calculating selfemployment tax While on this screen, click IRS Form Instructions on the right side of the screen for additionalDec 30, Step by Step

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

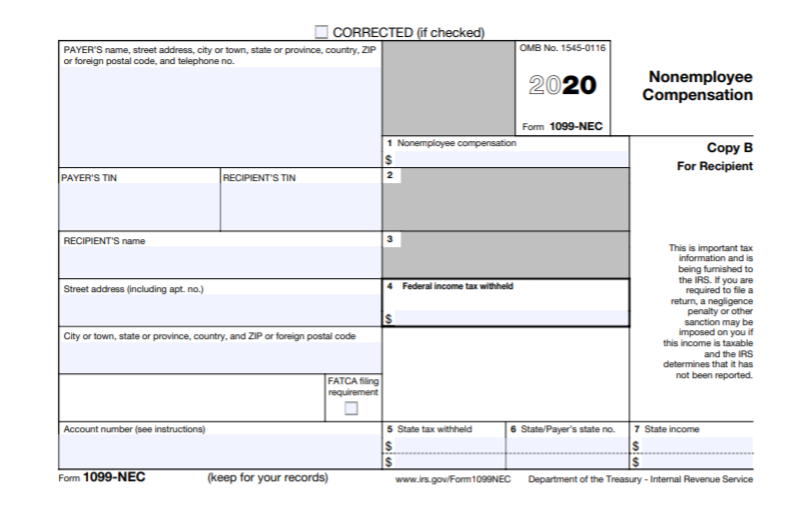

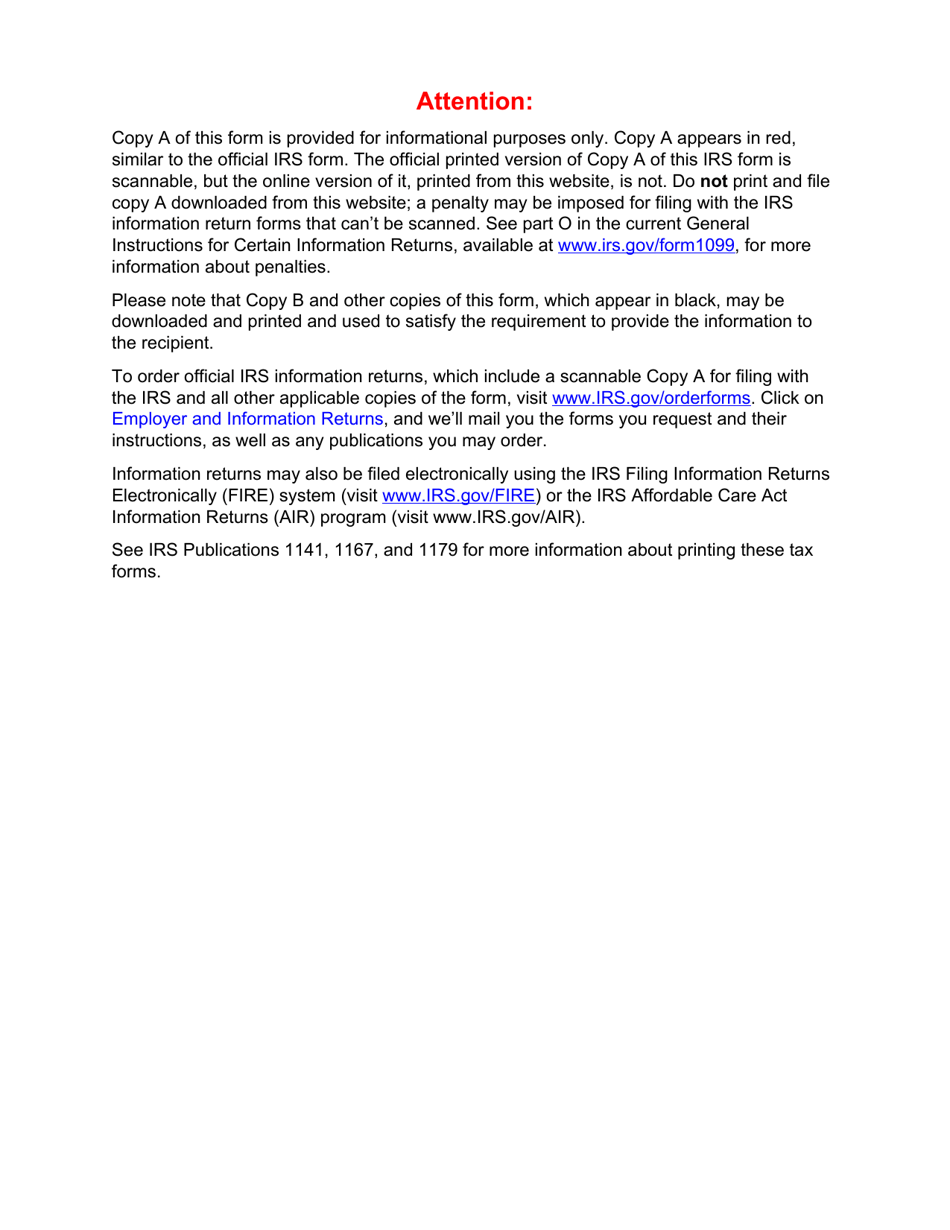

Yes—your Form 1099NEC will provide info that you'll need to add to your Schedule C, which is where you report income and expense details for your business You'll also file Schedule SE, SelfEmployment Tax, to pay your Social Security and Medicare taxes If you already have a Schedule C in your return, edit it and go to the section to Add Income This is where you will reenter the Form 1099NEC If you do not already have a Schedule C in your return, follow the prompts and enter the information about your work/business for which you received the Form 1099NEC Download Form 1099NEC Nonemployee Compensation Here is a link to a downloadable Form 1099NEC for the tax year 21 Copy A of the form is in red;

When I fill out the 1099 NEC it automatically fills out the schedule c But it adds the income to both lines So the 1099 goes up by the income amount as well as the schedule cForm 1099NEC 21 Cat No N Nonemployee Compensation Copy A For Internal Revenue Service Center Department of the Treasury Internal Revenue Service File with Form 1096 OMB No For Privacy Act and Paperwork Reduction Act Notice, see the 21 General Instructions for Certain Information Returns 7171 VOID CORRECTEDA form 1099 is not the same as a Schedule C form A form 1099 is a tax form used by companies to report payments they've made, other than regular wages, salaries or tips (which are reported through a W2 form) If a business provides you with employment, but you do not work for that company full time, then you are considered a freelancer or

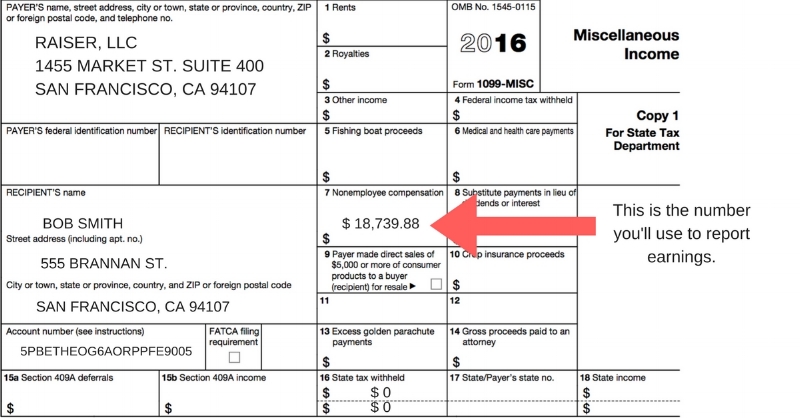

1099 MISC Form other boxes Due to the revived 1099 NEC Tax Form, Form 1099 MISC has been revised and boxes are rearranged as follows If the taxpayer made direct sales, the report the payments through 1099 MISC box 7 The taxpayer reports crop insurance proceeds through 1099 MISC Box 6If you use a tax filing software, this form will be automatically generated when you report that you are selfemployed, or that you received a 1099NEC or 1099K Even if you don't receive a 1099NEC, you may have to report your selfemployment income But the 1099MISC form is still around, it's just used to report miscellaneous income such as rent or payments to an attorney Although the 1099MISC is still in use, contractor payments made in and beyond will be reported on the new form 1099NEC The due date for the 1099NEC is January 31 in the year following the applicable tax year

Why Didn T Uber Eats Send A 1099 Why 1099 K Entrecourier

/1099-NEC-e196113fc0da4e85bb8effb1814d32d7.png)

How To Report And Pay Taxes On 1099 Nec Income

I am using Quicken for Windows Home, Business & Rental Property, version R3210, build 27 on Windows 10 HomeIt is for informational purposes and Internal I have received a 1099NEC form for income that was previously reported on 1099MISC I do not find the 1099NEC form on the list of tax forms to assign to categories When will this form be added?

Irs Form 1099 Misc 1099 Nec A New Filing Requirement For Independent Contractor Payments Kbf Cpas

Form 1099 Nec Nonemployee Compensation 1099nec

IRS Form 1099 NEC Line by Line Instructions Explained Updated on 1030 AM by Admin, TaxBandits Form 1099NEC is an information return that is used to report nonemployee compensation to the IRS The non employee compensation includes payments made to freelancers, independent contractors, and other selfemployed individuals Available in mobile app only Feature available within Schedule C tax form for TurboTax filers with 1099NEC income YearRound Tax Estimator Available in TurboTax SelfEmployed and TurboTax Live SelfEmployed starting by end of February This product feature is only available after you finish and file in a selfemployed product1099NEC 1099NEC (nonemployee compensation) is a new IRS form created for companies to report payments made to an individual who performed services in the course of business as a nonemployee Such nonemployees are commonly independent contractors, and may also include payments made to other service providers such as attorneys

Entering Form 1099 Misc With Nonemployee Comp Crosslink Tax Tech Solutions

Form 1099 Nec What It S Used For Priortax Blog

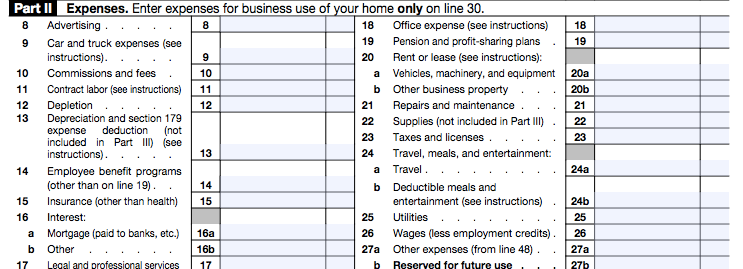

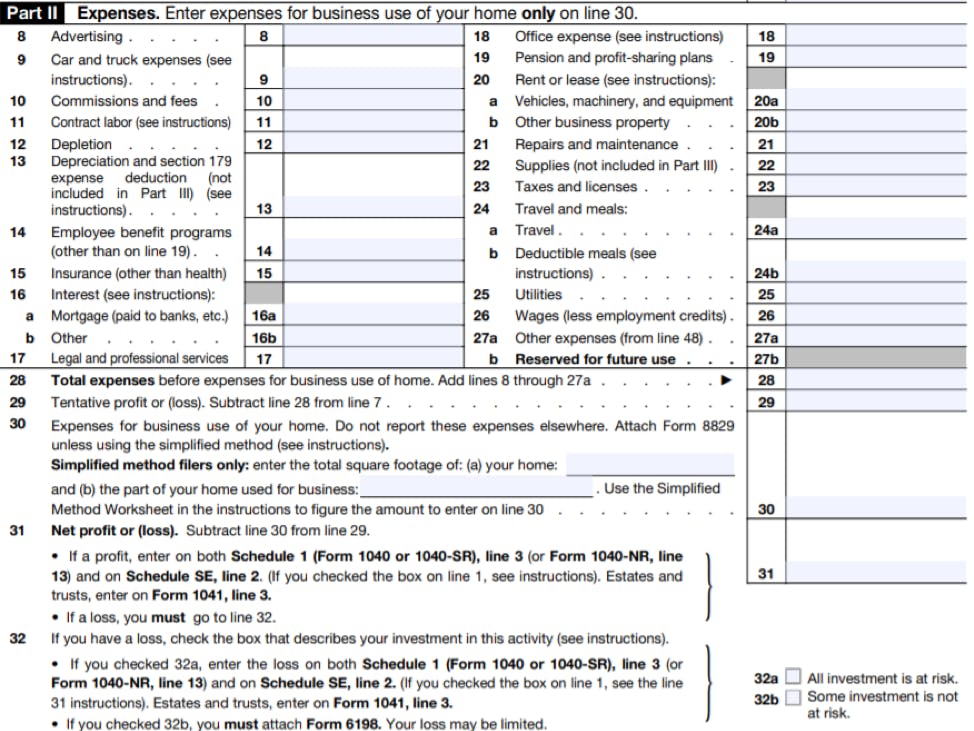

Schedule C – Less Common 1099 Expenses Services provided by the persons employed by you Hope this article gave a clear picture about the business expenses of Form 1099 Schedule C For further assistance and Clarifications, you are just a call away from us to reach our customer support team at or drop a mail at support@tax2efileBasically, Form 1099NEC is an entire form dedicated to Box 7 on Form 1099MISC Subsequently, for tax year , Box 7 has been removed from Form 1099MISC Essentially, Form 1099NEC serves a similar purpose as Form W2 does for employees That purpose is to report the total amount of payments a person receives from a single person or If an individual is paid $600 or higher in nonemployee compensation, they will be issued a 1099NEC for incomeThe IRS has reissued the form 1099NEC for the tax season to replace box 7 on the 1099MISC, which up until recently was standard for reporting nonemployee paymentsAny income appearing in box 7 of a 1099MISC prior to is

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

Independent contractors use the Schedule C form to report business income If you're a 1099 contractor or sole proprietor, you must file a Schedule C with your taxes Your Schedule C form accompanies your 1040 and reports business income, expenses, and profits or losses Schedule C is a sole proprietor tax form That means sole proprietorships, Starting in , you file Form 1099NEC for each independent contractor to whom you paid $600 or moreIf you miss the filing deadline, you are required to pay a fine

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

Re 1099 Misc Income Doesn T Appear On Schedule C

Starting with the tax year , Form 1099NEC is replacing Form 1099MISC for nonemployee payments January 31 is the federal deadline for reporting nonemployee compensation on Form 1099NEC This was previously reported in box 7 of Form 1099MISCThe Bottom Line Business owners who pay nonemployees over $600 are required to file a 1099NEC on behalf of the freelancer to the IRS The 1099NEC Nonemployee Compensation is replacing the tax Form 1099MISC Miscellaneous Income for self employed people starting the taxThe business who hired a contractor files the form 1099NEC For every form there are two copies with the same information One copy goes to the IRS and the other copy goes to the contractor If you are the contractor receiving a copy of the 1099NEC, all of your NEC income goes on a schedule C when you file your taxes for that year What you

How To File Schedule C Form 1040 Bench Accounting

Irs Form 1099 Nec Download Fillable Pdf Or Fill Online Nonemployee Compensation 21 Templateroller

How you report 1099MISC income on your income tax return depends on the type of business you own If you are a sole proprietor or singlemember LLC owner, you report 1099 income on Schedule C—Profit or Loss From Business When you complete Schedule C, you report all business income and expenses Hi, Form 1099 NEC has been there for a long time Go to Forms, on the top bar, look for 1099 NEC Also if you go to the worksheet for the schedule c is also thereHow to enter Form 1099NEC on a tax return (Schedule C) Generally, Form 1099NEC Non Employee Compensation is issued to taxpayers when an employer pays $600 or more of fees, commissions, prizes, and awards for services performed by a nonemployee, other forms of compensation for services performed for your trade or business by an individual who is

What Is Form 1099 Nec Who Uses It What To Include More

I Received A Form 1099 Misc What Should I Do Godaddy Blog

You dont need the 1099 to report Sch C income, just enter all business income on Line 1 of the Sch C (since most self employed people have income in addition to the 1099 anyhow), as long as all income gets reported, that's all thats neededSince Form 1099NEC can be used to report income from a variety of sources, on screen 99N in the For drop list you must indicate whether you want the income to flow to Schedule 1, line 8, Other income Schedule C, Profit or Loss from Business Schedule F, Profit or Loss from Farming Form 19, Uncollected Social Security and Medicare Tax Incentive payments are still taxable income and must still be included on Schedule 1 of the Form 1040—the return you'll file in 21 But they're not taxed in quite the same way as earnings that appear in Box 1 of Form 1099NEC, "Nonemployee Compensation" This distinction is why you get to keep more of the money

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

Instructions For Forms 1099 Misc And 1099 Nec Internal Revenue Service

If you received a Form 1099NEC with nonemployee compensation but you should've received the income on a W2, you don't need a Schedule C for your 1099NEC We'll ask you questions to determine the amount of the Medicare and Social Security taxes thatAlso, use Schedule C to report (a) wages and expenses you had as a statutory employee, (b) income and deductions of certain qualified joint ventures, and (c) certain amounts shown on a Form 1099, such as Form 1099MISC, Form 1099NEC, and Form 1099K Income reported on Form 1099NEC must be reported on Schedule C, the program is trying to link these two forms together to be sure that it is reported correctly and on the right form Revisit the section where you entered the Form 1099NEC if you entered it on its own and delete that entry, by following these steps Open TurboTax

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

What Is An Irs Schedule C Form And What You Need To Know About It

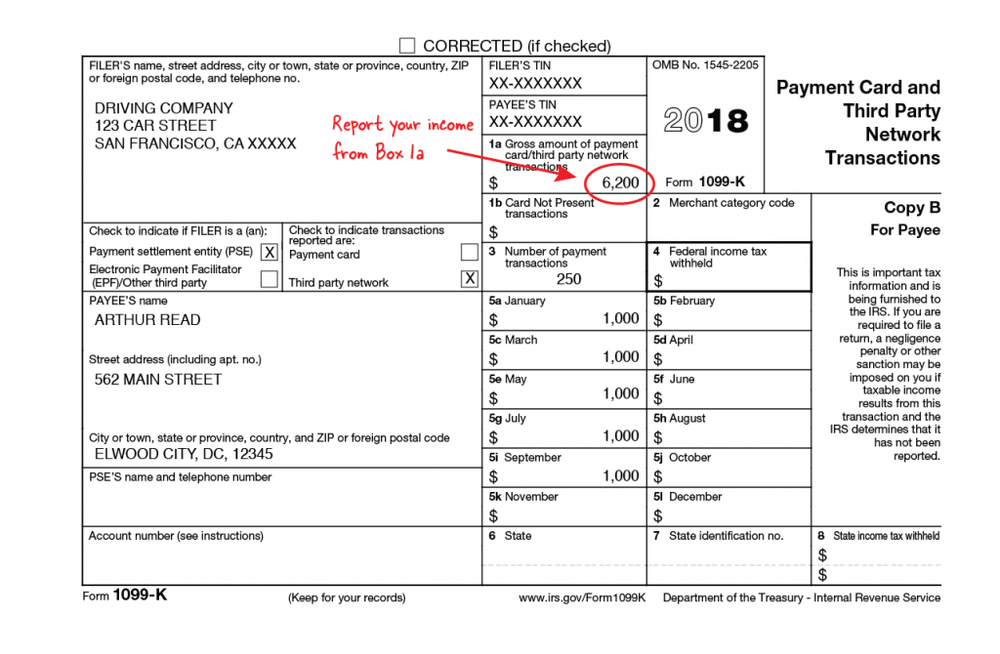

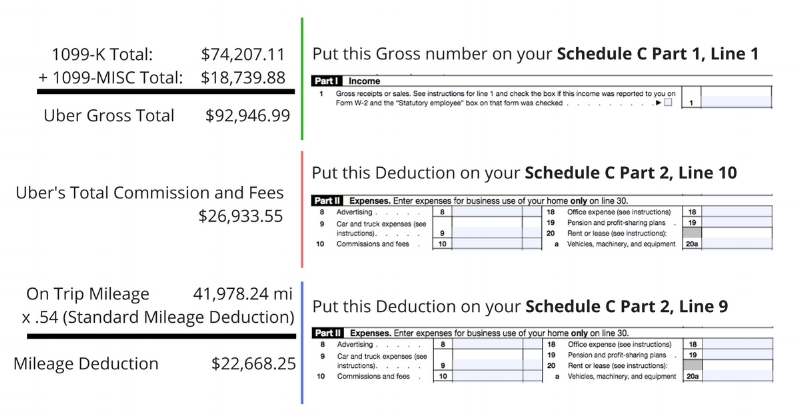

Mailing the 1099NEC to the IRS People and businesses that report 1099NEC income don't need to include the form with their tax returns Failure to meet the obligation to issue 1099NEC forms can lead to penalties and tax debt Not understanding how to deal with the form you receive can also lead to tax issues If your nonemployee compensation is selfemployment income, you'll also need to report the amount from your 1099NEC on Schedule C or F and on Schedule SE of your Form 1040 tax return And you'll need to file all those forms with your return Your tax software will ask you to fill out information from the forms and calculate the sum for you If you didn't receive a 1099NEC but have referral and incentive income to report, you can include it as "Other income" for your business If you're filling out a Schedule C Add the 1099K and 1099NEC earnings amounts together Then

Form 1099 Nec Is Making A Come Back

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

Instacart 1099 tax forms By January 31st, Instacart sends all their contractors 1099 forms and files a copy to the IRS too, complying with the US tax law Starting from 21, the previously used 1099misc forms are getting replaced with 1099NEC for nonemployee compensation This form documents your taxable income from last year made throughEnter a Schedule C with the profession, business code and name of the business Enter the 99M/99N screens for 1099Misc reporting or 1099NEC for nonemployee compensation;Form 1099NEC due date is January 31st However, in 21, the due date for 1099NEC is February 1, because January 31 falls on a Sunday What are the fines for missing a filing deadline for Form 1099NEC?

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income Pg2 4012 Pdf

What Is Irs Form 1099 Nec Everything You Need To Know

Mark them for the Schedule C and be sure to enter a multiform code that corresponds with the Schedule C involvedWhat you have to do is clear out the 1099 NEC you entered in the Wages and Income section Then go down till you find Schedule C click on it and start from there When you begin to do it, it'll ask you to enter your 1099s and afterwards will allow you to do your deductions I hope this helps One of the nice things about receiving a 1099NEC rather than a W2 is you can claim deductions on your Schedule C, which you use to calculate your net profits from selfemployment Your deductions must be for business expenses that the IRS considers ordinary and necessary for your selfemployment activities

What Information Is On My 1099 Nec Tax Form

1099 Rules For Business Owners In 21 Mark J Kohler

To associate the 1099MISC or a 1099NEC to a Schedule C, perform the following steps in the program After entering the information, click Continue to save and be taken to the next page You will then be asked where you want to add the income You can Create a new Schedule C or add the income to an existing Schedule C (same type of work)Screening Sheet for Volunteers Assisting Taxpayers with Form 1099C N746 Information About Your Notice, Penalty and Interest P1321 Special Instructions for Bona Fide Residents Of Puerto Rico Who Must File A US Individual Income Tax Return (Form 1040) How do I know if I need to file a Schedule C?

Form 1099 Nec Is Making A Come Back

1

Click Add Schedule C Continue with the interview process to enter all of the appropriate information On the screen titled We need to know if Taxpayer/Spouse received any of these for their work in , click the 1099NEC box, then click ContinueIf you are filing a 1099NEC with income in Box 1, you will be prompted to add the income to an existing Schedule C or create a new Schedule C after completing the 1099NEC entry If you receive a 1099K , the IRS requires this income to be reported as income on the Schedule CThe income reported to you on Form 1099MISC, Box 7, and any expenses applicable to this income, is entered in the Form 1099MISC (or Business Income) section of the TaxAct® program and will flow to Schedule C If you have not already entered the applicable Schedule C information From within your TaxAct® return (Online or Desktop), click Federal

What Is Irs Form 1099 Nec Everything You Need To Know

Common Mistakes On Credit Karma Free Tax Doordash Uber Eats Instacart

How To Fill Out 1099 Nec Red Forms For Irs Return Youtube

What Is A 1099 Nec Stride Blog

Freelancers Meet The New Form 1099 Nec

How To Fill Out And Print 1099 Nec Forms

Form 1099 Nec Block Advisors

1099 Misc Form Fillable Printable Download Free Instructions

What Is A 1099 K Stride Blog

Filing Form 1099 Nec Beginning In Tax Year Leone Mcdonnell Roberts Professional Association Certified Public Accountants

Irs Releases Form 1040 For Tax Year Taxgirl

Ultratax Cs Tax Forms Zbp Forms

Form 1099 Misc Vs Form 1099 Nec How Are They Different

What Is Form 1099 Nec Nonemployee Compensation

Freelance Taxes Income Taxes Arcticllama Com

Schedule C Multiple 1099 Misc 1099 Nec For Same Business 1099m 1099nec Schedulec

Form 1099 Nec Requirements Deadlines And Penalties Efile360

Irs Releases Form 1040 For Tax Year Taxgirl

What Is A 1099 Form H R Block

1

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Form 1099 Nec Nonemployee Compensation 1099nec

1099 Tax Form Fill Online Printable Fillable Blank Pdffiller

Ready For The 1099 Nec Emc Financial Management Resources Llc

How To Enter Form 1099 Nec On A Tax Return Schedule C Crosslink Tax Tech Solutions

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

Startchurch Blog Updates You Must Know 1099 Misc 1099 Nec

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

Www Irs Gov Pub Irs Pdf I1099msc Pdf

/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

What Is Form 1099 Nec For Nonemployee Compensation

Apps Irs Gov App Vita Content Globalmedia Teacher Schedule C Business Income 4012 Pdf

How To Use Your Uber 1099 K And 1099 Nec Stride Blog

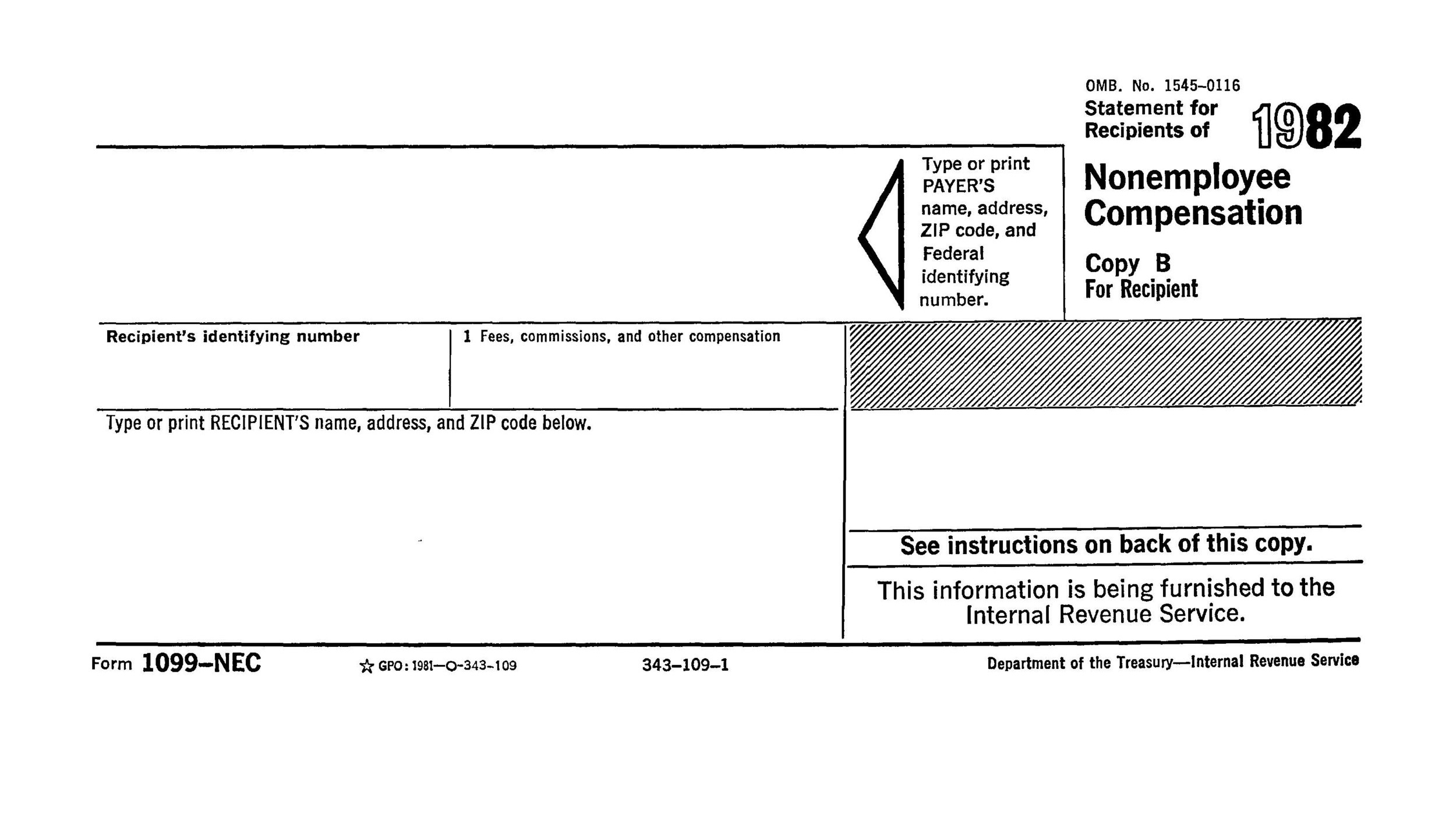

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

1099 Misc Form Fillable Printable Download Free Instructions

Major Changes To File Form 1099 Misc Box 7 In

How To File A Tax Return With A 1099 Independent Contractor Tax Preparation Youtube

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

1099 Nec Conversion In Page 2

1099 Nec Schedule C Won T Fill In Turbotax

Self Employed Priortax Blog

What Is Form 1099 Nec Nonemployee Compensation

What Is A Schedule C Stride Blog

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/1099-form-36a7b4ad438c4c1cbd53efb8e944cc6f.jpg)

Reporting 1099 Misc Box 3 Payments

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Form 1099 Misc Vs 1099 Nec Differences Deadlines More

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet

How To File The New Form 1099 Nec For Independent Contractors Using Turbotax Formerly 1099 Misc Youtube

/ScreenShot2021-02-07at12.05.18PM-be978757a0b5431d8a4642626004cbb3.png)

Schedule C Profit Or Loss From Business Definition

Form 1099 Nec For Nonemployee Compensation H R Block

Freelancers Meet The New Form 1099 Nec

1

Tax Documents That Every Freelancer And Contractor Needs Form Pros

1099 Rules For Business Owners In 21 Mark J Kohler

Here Are Key Tax Due Dates If You Are Self Employed Forbes Advisor

Your Ultimate Guide To 1099s

Working For Yourself What To Know About Irs Schedule C Credit Karma Tax

1

How To Prepare A Schedule C 10 Steps With Pictures Wikihow

1099 Nec Form Quicken

What Do The Income Entries On The Schedule C Mean Support

Amazon Flex 1099 Forms Schedule C Se And How To File Taxes And Estimated Taxes Money Pixels

Irs To Bring Back Form 1099 Nec Last Used In 19 Current Federal Tax Developments

What Is Irs Form 1099 Misc Miscellaneous Income Nerdwallet

Understanding Tax Form 1099 And The New 1099 Nec Gudorf Tax Group

How To File Form 1099 Nec For Tax Year 123paystubs Youtube

What Is Form 1099 Nec

Fill Free Fillable F1099nec Form 1099 Nec Pdf Form

What Is A 1099 Form And How Do I Fill It Out Bench Accounting

What Do The Expense Entries On The Schedule C Mean Support

Filing Cash Income Without A 1099 Form Form Pros

Self Employed Vita Resources For Volunteers

What You Need To Know About Instacart 1099 Taxes

How To Use Your Lyft 1099 Tax Help For Lyft Drivers Turbotax Tax Tips Videos

A Guide To Filling Out And Filing Schedule C For Form 1040 The Blueprint

How Do I Link To Schedule C On My 1099 Misc For Bo

/Clipboard01-f2dbf519c5934e4cb3d9baca6efe0ec7.jpg)

Form 1099 Misc Miscellaneous Income Definition

0 件のコメント:

コメントを投稿